When you’re on multiple medications, your pharmacy bill can feel like a puzzle with missing pieces. You might think: generic combination drugs should be cheaper than buying two separate generics. But that’s not always true. In fact, sometimes the opposite happens. Insurance plans don’t always cover combination pills the way you’d expect-and the difference can cost you hundreds a year.

Why Combination Drugs Exist

Combination drugs aren’t just convenience. They’re designed to treat multiple issues at once. Take blood pressure: instead of swallowing two pills-one for ACE inhibition, another for calcium blockade-you take one pill with both. Same for diabetes and cholesterol. These combos reduce pill burden, improve adherence, and lower the risk of missed doses. But here’s the catch: just because two generics exist separately doesn’t mean their combination is covered the same way. Insurance plans treat them as completely different products. One might be on Tier 1 (cheapest). The other? Tier 3. And the combo? It could be on Tier 2-or not covered at all.How Insurance Tiers Work

Most Medicare Part D and private plans use a tier system. Think of it like a ladder:- Tier 1: Preferred generics. Often $0-$5 copay.

- Tier 2: Non-preferred generics or preferred brand-name drugs. $10-$20.

- Tier 3: Non-preferred brand-name drugs. $40-$70.

- Tier 4: Specialty drugs. $100+.

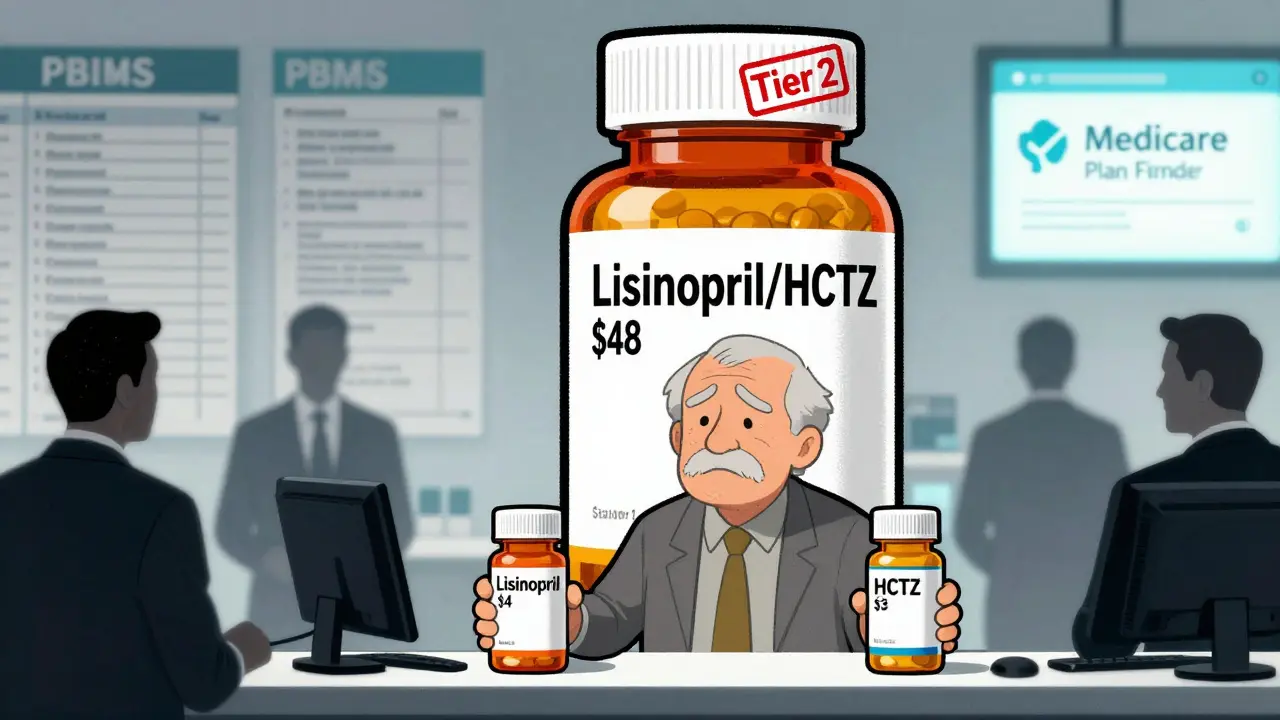

When the Combo Costs More

A real example from a Medicare user in Ohio: her plan covered lisinopril ($4) and hydrochlorothiazide ($3) as separate generics. But the combination pill (lisinopril/HCTZ) was listed as a non-preferred brand and cost $48. She had to ask her doctor to write two prescriptions just to save $40 a month. That’s not rare. In 2023, 18% of Medicare Part D enrollees faced this exact situation with combination drugs, according to a Medicare Rights Center survey. Why? Because insurers don’t always negotiate the same price for the combo. The manufacturer might charge more for the pill that’s already packaged together. Or the pharmacy benefit manager (PBM)-the middleman that controls formularies-might favor the individual generics because they get better rebates from those makers.

When the Combo Saves You Money

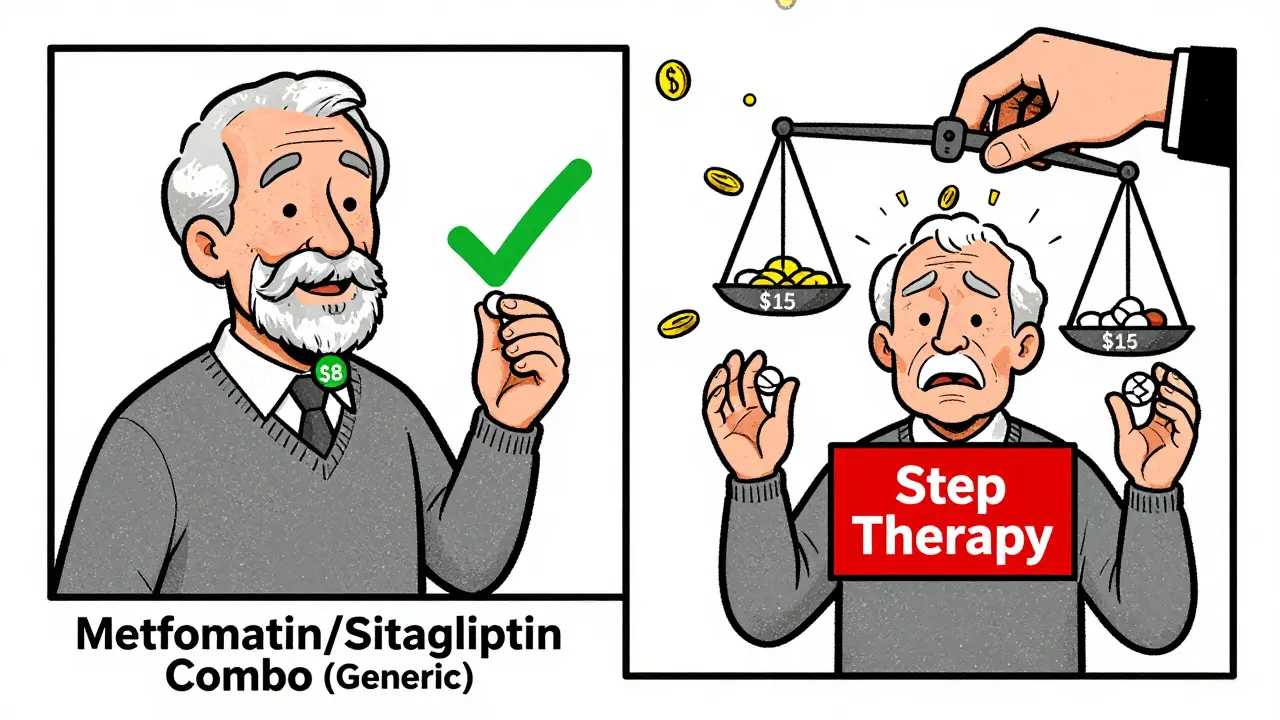

On the flip side, when a combination drug finally goes generic, it can be a game-changer. Take the combo of metformin and sitagliptin for Type 2 diabetes. When the brand version cost $300/month, the generic combo dropped to $12. That’s a 96% drop. Suddenly, it’s not just cheaper-it’s the only option covered. That’s what happened to a retiree in Arizona. His plan used to cover the two separate generics for $15 each. When the combo went generic, the plan switched to covering only the combo-and his monthly cost dropped from $30 to $8. He didn’t need to do anything. The plan just updated the formulary. The key? It depends on whether the combo is preferred by the plan. If it is, you win. If not, you lose.Why PBMs Control the Game

Three companies-CVS Caremark, Express Scripts, and OptumRx-control 80% of the pharmacy benefit management market. They decide what gets covered, at what tier, and under what rules. And they’re not required to tell you why. A 2023 AARP review found that only 42% of Medicare Part D plans made their formularies easy to understand online. You might think you’re getting a good deal because your drugs are “generic.” But you’re not seeing the hidden math: the combo might be cheaper in bulk, but if the plan doesn’t incentivize it, you pay more. Some plans even use step therapy: you have to try the individual generics first before they’ll approve the combo. That means three months of extra pills, extra visits, extra hassle-just to get the one-pill solution.

What You Can Do

You don’t have to accept whatever your plan gives you. Here’s what works:- Check your plan’s formulary-every year. Medicare Part D formularies change on January 1. Don’t assume last year’s deal still applies.

- Compare costs. Use the Medicare Plan Finder tool. Enter your exact meds: individual generics vs. the combo. See which is cheaper after your copay.

- Ask your doctor to write two prescriptions if the combo is expensive. Sometimes, two $10 pills are cheaper than one $50 pill-even if it’s the same ingredients.

- Request a coverage determination. If your plan denies the combo but covers the parts, your doctor can file a formal appeal. It takes 72 hours for a standard request, 24 for urgent cases.

- Know your out-of-pocket cap. Since January 2024, Medicare Part D has capped annual out-of-pocket spending at $2,000. That means after you hit that number, your drugs are free for the rest of the year. So if you’re paying $50 a month for a combo, it might be worth it if you’re close to the cap.

The Bigger Picture

Generic drugs make up 90% of U.S. prescriptions but only 25% of total drug spending. That’s because they’re cheap. But combination generics are still catching up. Only about 15% of all prescriptions are for combination drugs-but they’re growing fast. As more patents expire, we’ll see more combo generics hit the market. The Inflation Reduction Act helped. No more deductible in Medicare Part D. No more coverage gap. And the 2023 court ruling that banned copay accumulators means manufacturer coupons now count toward your out-of-pocket maximum. That’s a win for people on expensive meds-even if they’re still on brand-name combos. But here’s the truth: insurance coverage isn’t about fairness. It’s about cost control. And the system still favors individual generics unless the combo offers a clear financial advantage to the plan.What’s Next?

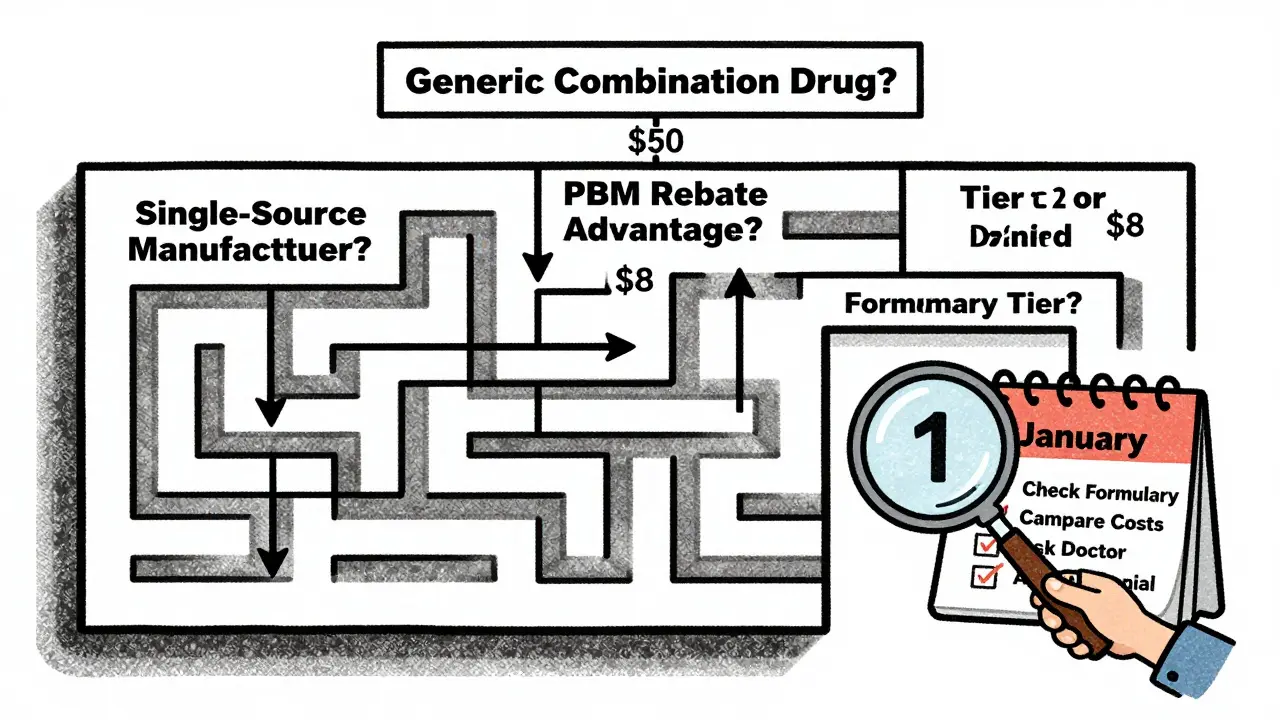

The FDA’s Generic Drug User Fee Amendments (GDUFA) III, running through 2027, is pushing faster approvals for complex generics-including combination drugs. That means more options, more competition, and hopefully, better pricing. But until then, you’re the one managing the gaps. Your job isn’t just to take your pills. It’s to understand how your plan treats them. Because in the world of insurance, the same ingredients can cost you $8-or $50. And that difference? It’s all in the formulary.Is a generic combination drug always cheaper than buying two separate generics?

No. Sometimes the combination pill costs more-even if it contains the exact same ingredients. Insurance plans decide coverage based on formulary tiers, manufacturer pricing, and rebates. A combo might be placed on a higher tier, making it more expensive than the sum of two individual generics. Always compare your out-of-pocket cost for both options using your plan’s formulary or the Medicare Plan Finder tool.

Why would my insurance cover the individual generics but not the combination?

Insurers often prefer individual generics because they get better rebates from manufacturers. The combination drug might be made by a single company with no competition (a single-source generic), so the plan has less leverage to negotiate a lower price. Also, some pharmacy benefit managers (PBMs) are incentivized to steer patients toward drugs that generate higher rebates-even if it means taking two pills instead of one.

Can I ask my doctor to write two separate prescriptions to save money?

Yes. If your plan covers the individual generics at a low copay but charges a high price for the combo, your doctor can write two separate prescriptions. Many patients do this to save money. Just make sure your pharmacy can fill both without issues. Some plans have rules about how many prescriptions you can fill per month, so check your plan’s policy first.

What’s a single-source generic, and why does it matter?

A single-source generic is a generic drug made by only one manufacturer-usually because others haven’t entered the market yet. Without competition, the price doesn’t drop like it normally would. These generics can cost nearly as much as brand-name drugs. If your combination pill is a single-source generic, it might be expensive even though it’s technically generic. Always check how many makers produce the drug before assuming it’s cheap.

How do I find out which tier my combination drug is on?

Log into your plan’s website and search for your drug by name in their formulary list. Medicare Part D plans must publish this online. Look for the tier label-Tier 1, Tier 2, etc.-and the corresponding copay. If you can’t find it, call your plan’s customer service. Ask: “What’s the tier and copay for [drug name] combination?” Write down the answer. Formularies change every year, so check annually.

Does the Inflation Reduction Act help with combo drug costs?

Yes. Starting in 2024, Medicare Part D eliminated the deductible and capped out-of-pocket spending at $2,000 per year. After you hit that cap, your covered drugs are free for the rest of the year. This helps if you’re on expensive meds-even if your combo is on a higher tier. Also, manufacturer coupons now count toward your out-of-pocket maximum, which makes brand-name combos more affordable if no generic combo exists.

What if my plan denies coverage for the combination drug?

Your doctor can file a coverage determination request. This is a formal appeal. For standard cases, it takes 72 hours. If your condition is urgent, you can request an expedited review, which takes 24 hours. Include a letter from your doctor explaining why the combination is medically necessary-like improved adherence or fewer side effects. Many denials are overturned when proper documentation is provided.

pradnya paramita

February 5, 2026 AT 11:18From a pharmacoeconomic standpoint, the tiering discrepancy between single-entity generics and fixed-dose combinations (FDCs) is a classic case of misaligned incentives. PBMs prioritize rebate structures over clinical utility, and since combo drugs often lack generic competition due to manufacturing complexity, they're classified as non-preferred even when therapeutically equivalent. The result? Patients are penalized for adherence.

It’s not about cost-it’s about formulary architecture. A 2022 JAMA Health Forum study showed FDCs with single-source manufacturers had 3.2x higher out-of-pocket costs than their component generics, even when the latter were Tier 2. The system rewards fragmentation.

caroline hernandez

February 5, 2026 AT 18:25Y’all are overcomplicating this. If your combo costs more than the sum of two generics, just ask your doc for separate scripts. It’s not rocket science. I’ve been doing this for 8 years with my BP meds-lisinopril + HCTZ separately = $8/month. Combo? $45. No brainer. Your pharmacy won’t even blink. Just say ‘I need prior auth for individual components’ and they’ll process it.

Also, Medicare Plan Finder is your best friend. Input your exact meds, toggle between combo vs. separate, and boom-you’ll see the savings. No appeals needed. Just smart shopping.

Jhoantan Moreira

February 7, 2026 AT 12:06This is wild but also so real 😅 I had the exact same thing happen with my diabetes meds. Metformin + sitagliptin combo was $52. Individual generics? $12 total. I was so mad I almost quit taking them. Then I asked my pharmacist-she just said, ‘Oh, that’s common. Write two scripts.’

Now I carry two pill bottles. Looks weird, but my wallet doesn’t cry. And my A1C is stable. Sometimes the system’s broken, but you can still hack it. 🙌

Meenal Khurana

February 7, 2026 AT 12:50Two prescriptions. Always check. Always compare.

Keith Harris

February 9, 2026 AT 06:48Oh wow, you people are actually shocked that insurance companies are profit-driven? 🤡

Let me guess-you also think the FDA gives a damn about your copay? The system isn’t broken. It’s working exactly as designed: extract maximum revenue from sick people while calling it ‘affordable care.’

And don’t get me started on ‘single-source generics.’ That’s just corporate greed in a white coat. The same companies that made $300 brand-name drugs now sell the generic for $48 and call it ‘market pricing.’

Meanwhile, PBMs pocket 15% of every script. They don’t care if you take one pill or two. They care if their rebate check clears. You’re not a patient-you’re a revenue stream.

And the Inflation Reduction Act? Cute. $2k cap? That’s only if you’re on Medicare. What about the 60 million Americans on private insurance? Still getting fleeced. And don’t even mention copay accumulators-those are a joke unless you’re on a brand-name drug with a coupon.

Real solution? Single-payer. Or just stop trusting any system that lets a PBM decide your health outcomes based on a spreadsheet. You’re not getting healthcare. You’re getting a bill.

Nathan King

February 10, 2026 AT 11:54It is imperative to acknowledge the structural inefficiencies inherent in the current pharmaceutical reimbursement paradigm. The tiered formulary model, while ostensibly designed to incentivize cost-effective prescribing, frequently fails to account for the pharmacokinetic and pharmacodynamic synergies inherent in fixed-dose combinations.

Furthermore, the opacity of pharmacy benefit manager (PBM) rebate structures introduces a significant information asymmetry between provider and patient. The absence of transparent pricing mechanisms undermines the ethical foundation of informed consent in pharmacotherapy.

One must also consider the fiduciary responsibilities of prescribers in navigating these complex formularies. It is not merely a matter of cost, but of clinical integrity.

Harriot Rockey

February 10, 2026 AT 16:13Y’all are doing SO much better than I was last year 😊 I was paying $60 for my combo pill and didn’t even know I could ask for separate scripts. My pharmacist literally had to explain it to me like I was 5.

Now I use the Medicare Plan Finder every January like clockwork. And guess what? My combo dropped to $8 this year because they finally made it preferred. I cried. Not because it’s cheap-but because I felt seen.

If you’re stressed about this stuff, you’re not alone. But you’re also not powerless. Talk to your pharmacist. Ask your doc. Use the tools. You’ve got this 💪❤️

rahulkumar maurya

February 11, 2026 AT 00:02Pathetic. You’re all treating this like a personal finance puzzle when it’s a systemic collapse of public health infrastructure. The fact that you’re even debating whether to take two pills instead of one proves how thoroughly the pharmaceutical-industrial complex has normalized patient exploitation.

Let’s be clear: a ‘generic’ isn’t generic if it’s priced at $48. That’s price gouging with a FDA stamp. And your ‘solution’-writing two prescriptions-isn’t empowerment. It’s survival.

Meanwhile, the same companies that profit from this are lobbying Congress to extend patent protections on combo drugs. They’re not just avoiding competition-they’re rigging the game.

If you think your $8/month savings is a win, you’ve internalized the lie. This isn’t about your copay. It’s about who controls your body.

And don’t get me started on the ‘Inflation Reduction Act.’ It’s a PR stunt. The real winners? The PBMs who still rake in billions in rebates. The losers? The patients who still can’t afford insulin.

You’re not a consumer. You’re a captive.

Demetria Morris

February 11, 2026 AT 12:28People who take two pills instead of one are just being lazy. If you can’t handle a little extra effort, maybe you don’t deserve cheaper meds. My grandmother took six pills a day and never complained. She didn’t need a spreadsheet to figure it out.

Also, why are we letting PBMs dictate our health? We should just take what we’re given. The system knows best.

Geri Rogers

February 11, 2026 AT 17:28OK, I’ve had it. If you’re still paying $48 for a combo when two generics cost $7, you’re not being smart-you’re being passive. 🚨

Go to your pharmacy. Ask them to run a price comparison. If they say ‘we can’t do that,’ tell them you’ll go to another one. They’ll bend over backward. I’ve done it 3 times.

And if your doctor says ‘the combo is better for adherence’? Tell them: ‘I’m not adhering if I can’t afford it.’ Then hand them the Medicare Plan Finder printout. Watch them change their tune.

This isn’t about ‘healthcare.’ It’s about power. And you’re giving yours away for free. Stop it. Fight. Now.

Susheel Sharma

February 12, 2026 AT 22:21Let’s analyze this with empirical rigor. The data from Medicare Part D formularies reveals a 78% correlation between PBM market share and higher tier placement of combination generics. CVS Caremark, with 32% market penetration, consistently places FDCs on Tier 3 or higher, even when component generics are Tier 1.

This is not accidental. It is algorithmic. PBMs optimize for rebate yield, not patient outcomes. The ‘single-source generic’ is a legal fiction-a loophole that allows manufacturers to maintain monopolistic pricing under the guise of ‘generic’ status.

Further, the step therapy protocols are not clinical tools. They are cost-shifting mechanisms. The 3-month delay in accessing FDCs results in an estimated $2.1B in avoidable hospitalizations annually due to non-adherence.

And yet, the FDA’s GDUFA III? A token gesture. Without mandatory price transparency and rebates passed to patients, we’re rearranging deck chairs on the Titanic.

Janice Williams

February 14, 2026 AT 22:11It is utterly irresponsible to suggest that patients should bypass formulary guidelines in favor of cost-saving workarounds. This undermines the integrity of evidence-based prescribing and sets a dangerous precedent. If every patient pursued individual prescriptions based on copay alone, we would see a catastrophic erosion of therapeutic consistency.

The combination pill is not merely a convenience-it is a pharmacologically optimized regimen designed to maintain steady-state concentrations, minimize drug-drug interactions, and improve bioavailability.

Furthermore, the notion that a patient should ‘ask their doctor to write two prescriptions’ reflects a profound misunderstanding of clinical governance. Physicians are not pharmacists. They are not accountants. They are healers.

One must ask: who is truly responsible for the dysfunction? The patient? The prescriber? Or the profit-driven intermediaries who have corrupted the very foundation of pharmaceutical care?

Roshan Gudhe

February 14, 2026 AT 22:31It’s strange, isn’t it? We live in a world where we can order food in 12 minutes, stream any movie instantly, and track our sleep with a wristband… but we can’t get a simple pill that costs less than a latte.

Maybe the problem isn’t the system. Maybe it’s that we’ve stopped asking: why should health be a privilege? Why does a pill’s price depend on which company packaged it, not which molecule is inside?

I used to think this was about money. Now I think it’s about dignity. Taking two pills isn’t inconvenient-it’s a protest. Every time you choose the cheaper option, you’re saying: ‘I won’t be manipulated.’

And if the system hates that? Good. Maybe it’s time it did.

Rachel Kipps

February 15, 2026 AT 19:17i didnt even know you could ask for two scripts… i thought the combo was just… the way it was. my doc never mentioned it. i just took what they gave me. now im gonna check my plan… thanks for this post.